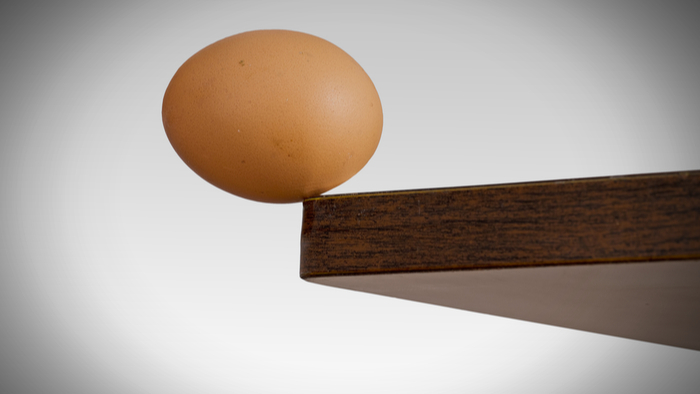

My recent research into societal collapse (watch this space) lead me to John Michael Greer, who offered an uncommonly wise perspective, so I purchased this book to update myself on his post-peak oil thinking.

My recent research into societal collapse (watch this space) lead me to John Michael Greer, who offered an uncommonly wise perspective, so I purchased this book to update myself on his post-peak oil thinking.

It describes progress as a 'civil religion' and examines how deeply ideas and more importantly assumptions about progress lie in our civilisation's narrative compared, say to other civilisations which reified the past or the unchanging nature of things.

I was privileged to attend the Basic Income Earth Network (

I was privileged to attend the Basic Income Earth Network (